Crafting an Effective Real Estate Investment Deck: A Step-by-Step Guide

Hello! As a real estate investment consultant, I create a lot of PowerPoint real estate investment memos for my clients. Many of these share common traits, so I thought it would be a fun exercise to create a generalized template to share as a download and portfolio reference for prospective clients. Feel free to repurpose this template as needed, and hopefully it saves you some time and helps you best pitch your deal!

The rest of this post will cover the technical PowerPoint aspects to modify this real estate investor deck template along with a general walkthrough of its contents. No deal is uniform, so you should definitely feel free to rearrange these slides and include additional pages to suit the specific needs of your deal.

Technical Notes

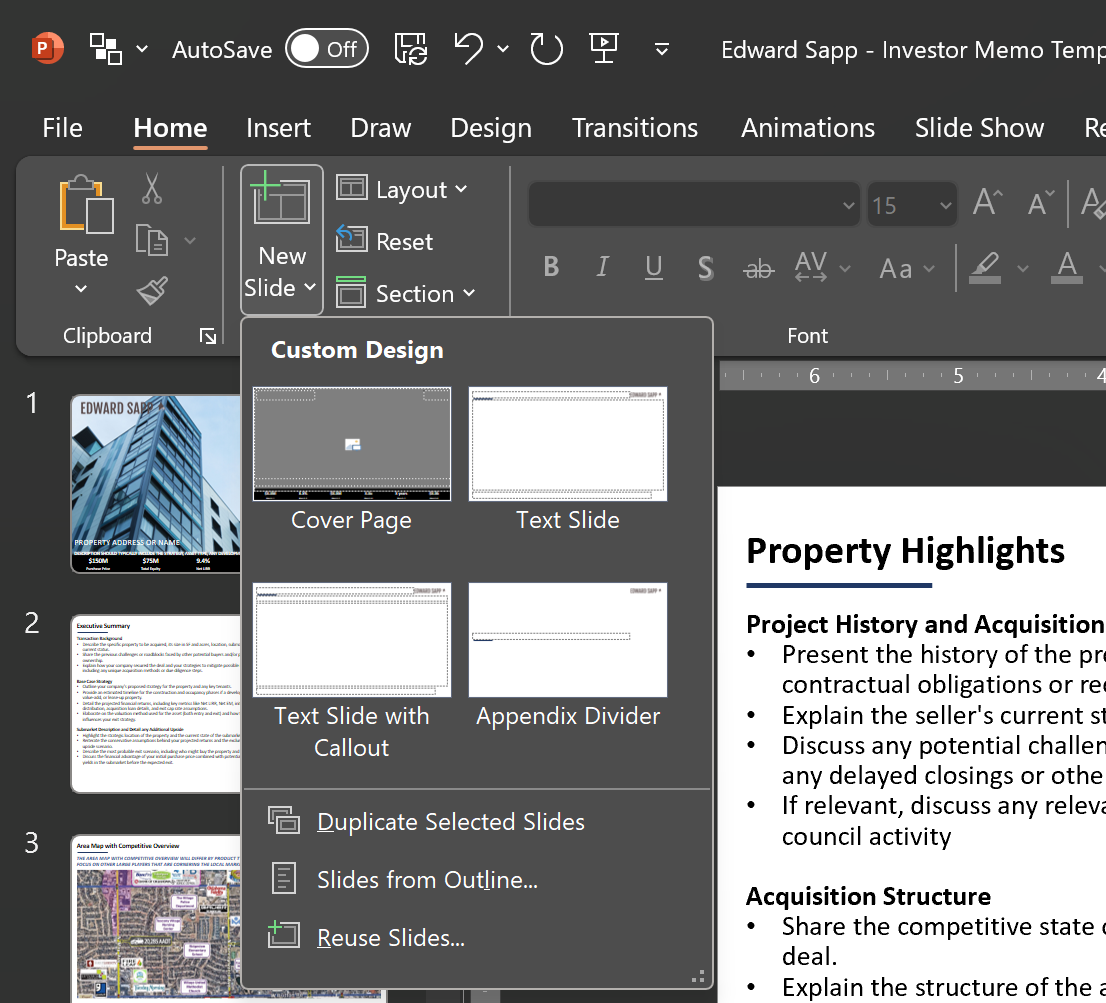

This investor template employs slide masters, which are a handy way of automating the redundant parts of slide creation. This means you'll be able to quickly insert pre-formatted slides, as shown in the following image:

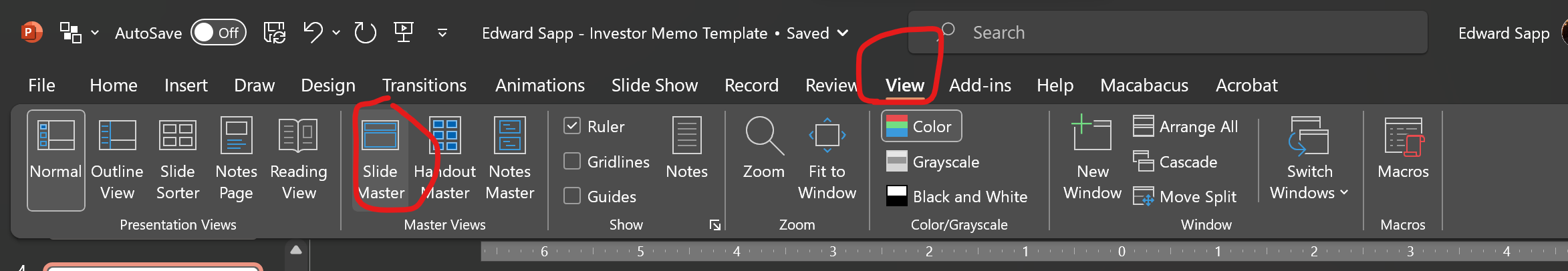

Before you get started, you'll probably want to tweak a few things, such as changing the logo in the presentation from my brand's logo to your own. You can do this by clicking View > Slide Master:

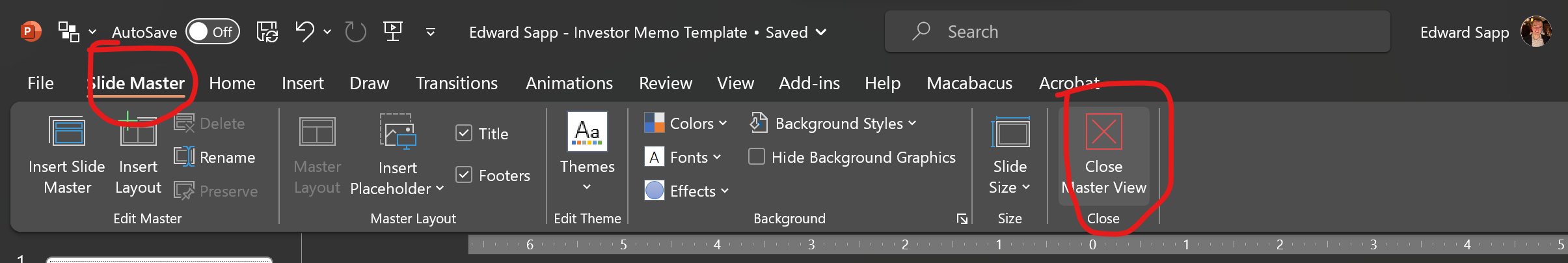

Once inside the Slide Master view, feel free to delete my logo and replace it with your own. You can also change any other styles here, and they will automatically change on the existing slides and on new slides that you insert using the insert slide method we already discussed. Once satisfied, you can close out of the Slide Master view and get back to the regular PowerPoint editor by clicking Slide Master > Close Master View:

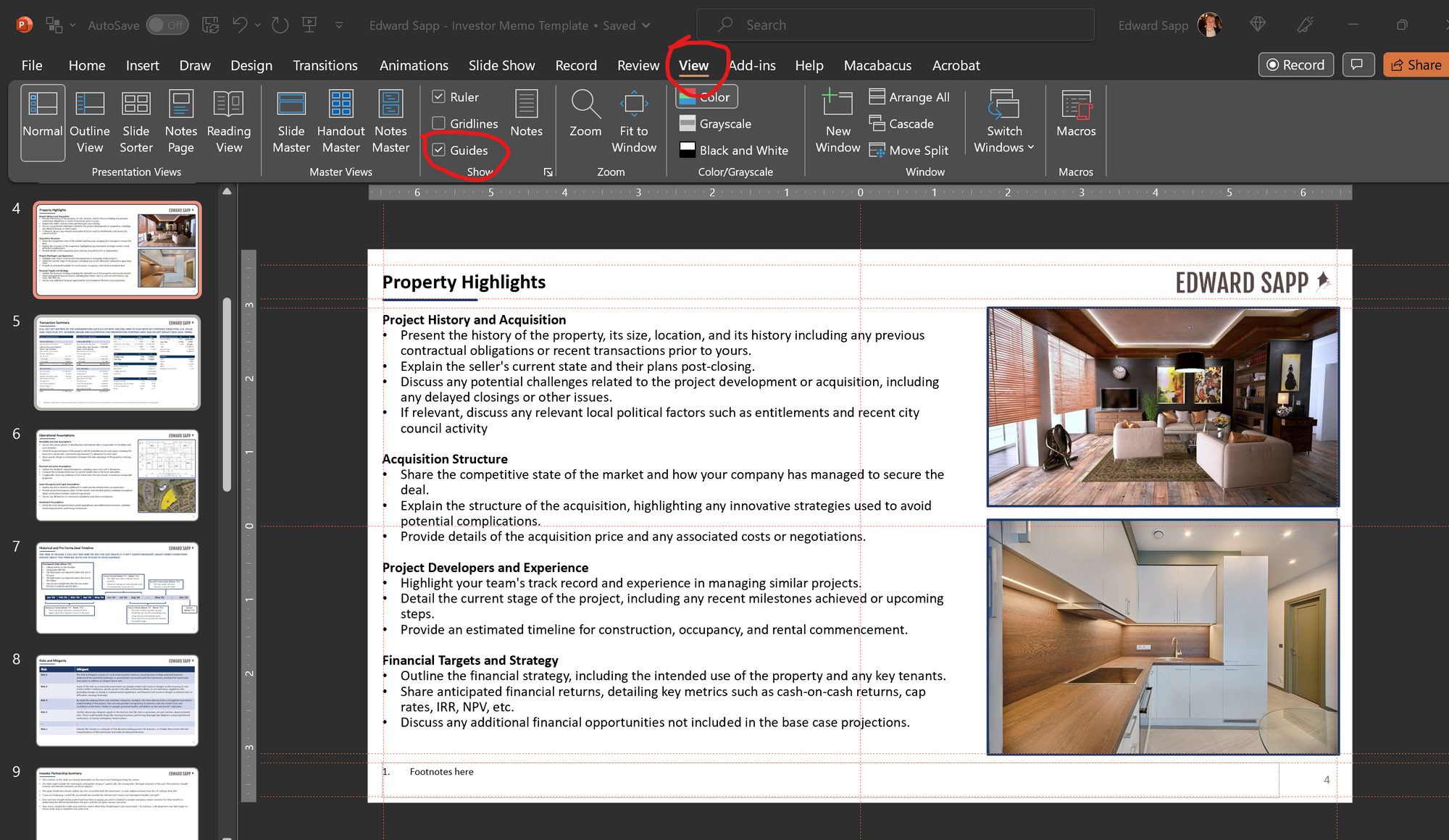

One more technical note you should be aware of. Positioning and layout are critical to developing a clean powerpoint presentation. You can view the layout guides I have created by typing Alt > W > S (Windows Only) or by pressing View > Guides on the toolbar, revealing the guides that you should follow when placing objects on your slides for a clean look and feel:

Finally, if you're going to be actively aligning objects, I highly recommend setting up the Align Objects Quick Access command, this tutorial should help you out. Now let's talk about each section of this memo!

Cover Page

Start your deck with a cover page with a large, striking image of the subject property. Include the name of the property along with a desrcription. Also include key metrics at the bottom of the page that outline the high-level price, equity required, and projected net returns to investors. Make sure to include any relevant branding and dates as well.

Executive Summary

Begin your deck with a concise summary of your project. Highlight your project's background, the strategy for profitability, the anticipated timeline, and any particular strengths of the location or market. This slide sets the tone for the rest of the presentation. Here are a few points you should address:

- Transaction Background: Discuss the history of the property, previous owners, and how you acquired it. Detail the initial challenges and how you plan to overcome them.

- Investment Strategy: Explain your approach to repositioning the asset and projected returns. This might include construction timelines, financials, and leasing strategies.

- Submarket Analysis: Present the real estate market conditions in the area, the property’s strategic position, and potential benefits. Include future development plans and the expected timeline to exit the investment.

The executive summary is your elevator pitch. Try not to stuff too many words on this page, keep it high-level and use it as a means to tell a story that piques your audience's interest.

Area Map with Competitive Overview

This slide should give your audience a geographic sense for your property. Different strategies and asset classes will emphasize different things on their aerial map. For instance, a stabilized retail acquisition would emphasize the neighboring competition to your existing tenancy. On the other hand, a covered land play might emphasize the neighboring development activity and why your project might be the next target on a well-funded sponsor's hit list for vertical development.

Property Highlights

This slide should delve deeper into the project highlights. Again, the subject matter will vary depending on strategy (development, value-add, lease-up, stabilized yield play, etc.) and asset class. Generally, this is where you provide more details about the acquisition, the project team's experience, and your financial strategy.

- Project History and Acquisition: Talk about the past and current ownership of the property, the seller's intentions, and the circumstances leading to your acquisition.

- Acquisition Structure: Explain how you're acquiring the asset and why your approach is beneficial.

- Project Developers and Experience: Showcase your team's capabilities by highlighting their past achievements and experiences.

- Financial Targets and Strategy: Outline your financial goals and how you plan to reach them. Include information about major tenants, expected returns, and potential upsides.

Transaction Summary

This slide should provide a snapshot of the most important metrics associated with your deal. I typically reserve most of the other financial slides for the appendix, since I prefer to structure decks from a narrative perspective and find that too many numbers up front can derail the story. Make sure to include key facts such as your sources and uses, entry and exit valuation, timing, financing terms, and summary returns at the deal level and to investors.

Operational Assumptions

Use this slide to outline your project's specifics and the strategy behind them. Give a general overview of your project, mentioning its location, type, and development plans. Discuss the project's feasibility, cost estimates, and expected timeline. Include your plans for tenant mix, lease terms, infrastructure, and anticipated capital expenditures.

Timeline

The timeline slide should provide a high-level snapshot of important historical and projected events associated with the project. You might need to extend this slide to cover more than just one page.

Risks and Mitigants

The risks and mitigants section of your memo helps potential investors understand the potential challenges or uncertainties associated with the investment opportunity. It shows that your team is not just reactive, but proactive with the risks associated with the project. By explicitly outlining these risks, you demonstrate your thoughtfulness and prime your investors for the potential challenges ahead and how you would plan to deal with them.

Investor Partnership Summary

This slide essentially outlines the cost of doing business with you. Every sponsor has a unique fee structure, so you will likely know how you wish to present this slide. I suggest putting this toward the back of the narrative, because the spotlight should be on the deal and not the associated fee structure.

Sponsor Overview

This slide is for showcasing your team's expertise and credibility. I suggest that you include the following:

- Sponsor Background: Describe your team's past accomplishments, the amount of capital managed, and any special focus areas.

- Partner Details: Discuss the credentials and relevant experiences of any partner organizations involved in the project.

Deal Team

This slide should list the key players involved in the deal, including legal advisors, tax consultants, project managers, and architects. This provides reassurance to potential investors about the depth and breadth of expertise supporting the project.

Post-Investment Expectations

Here, you'll prepare your potential investors for what they should anticipate post-investment. Discuss topics like bonus depreciation, cash flow distributions, and debt refinance or return of capital options. This is about setting clear expectations and illustrating the benefits of investing in your project.

Appendix

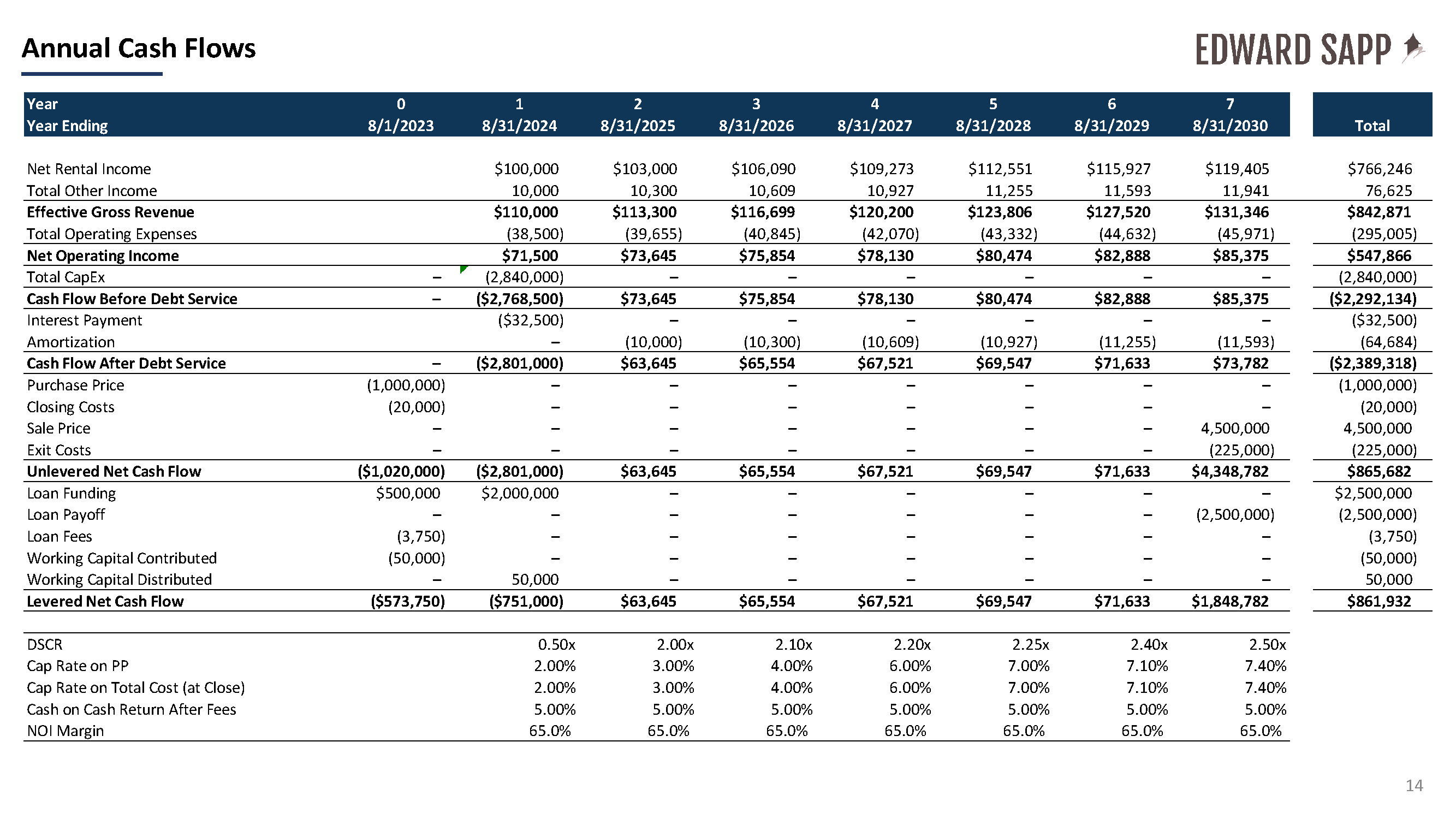

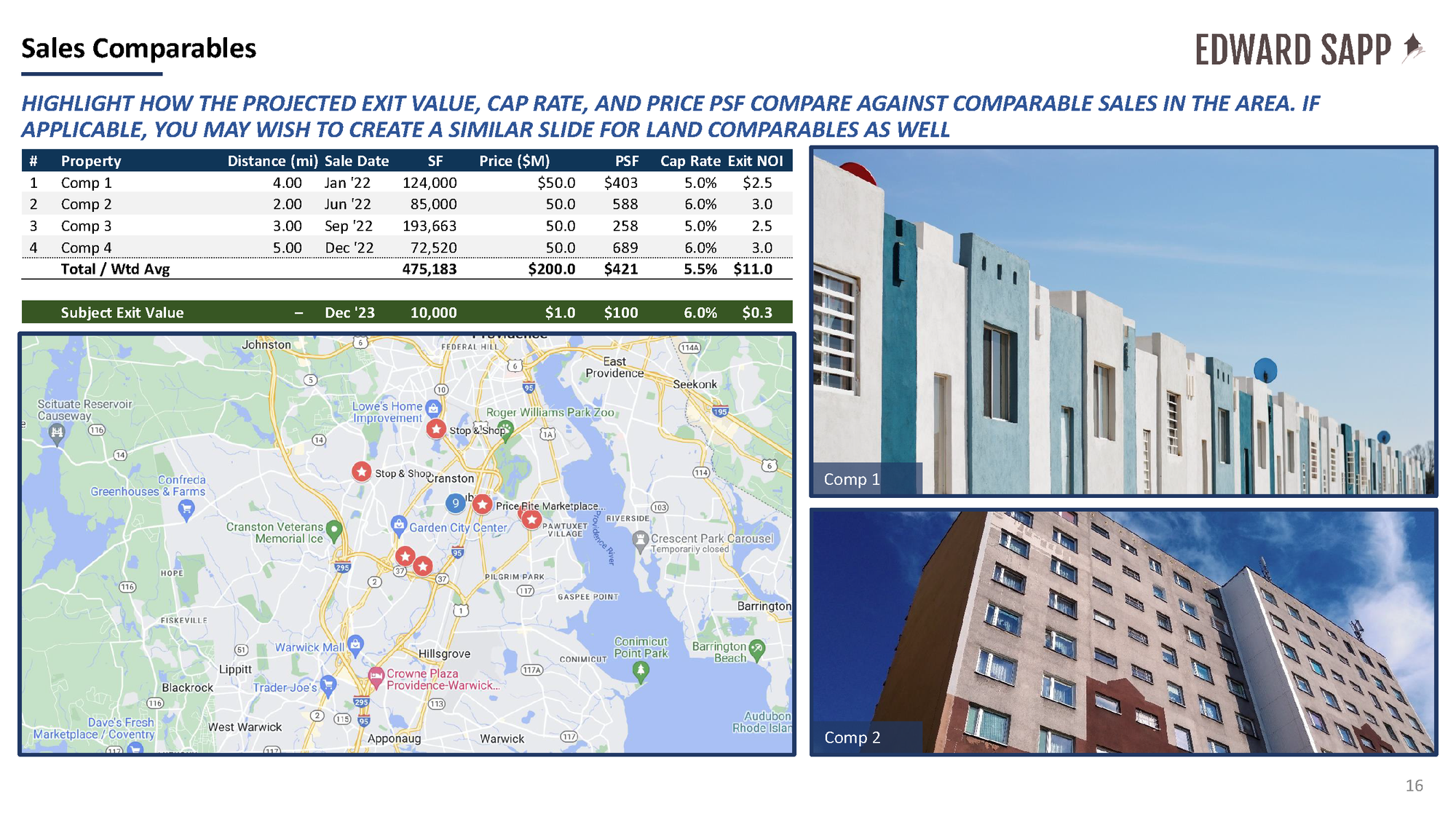

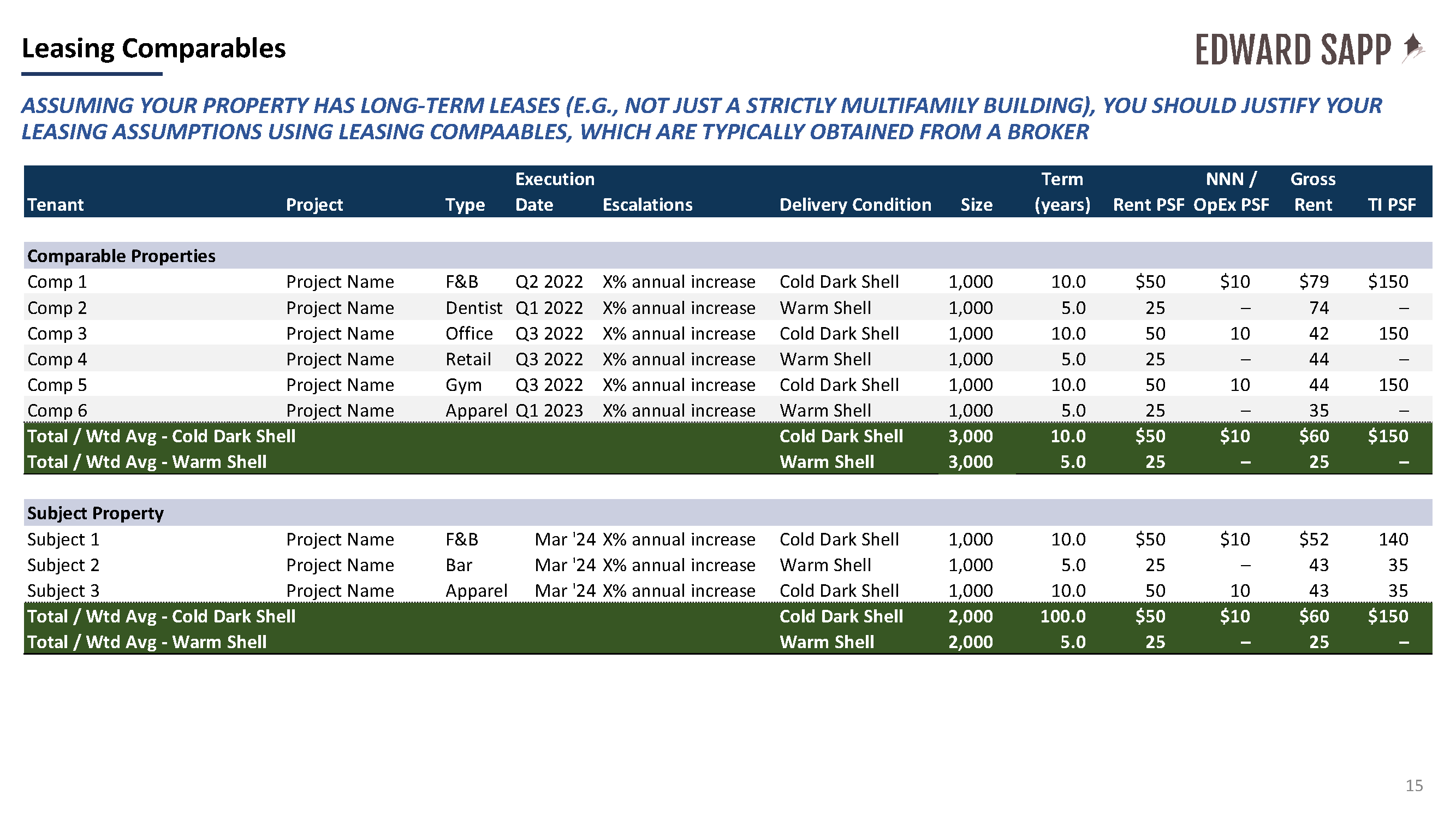

Lastly, the appendix serves as the reservoir for all the additional information that didn't fit into your primary presentation. This might include specifics on leases, capital expenditure details, architectural documents, zoning details, detailed financial projections, and any supplementary data that bolsters your case.

Conclusion

Remember, each real estate investment deck should be tailored to its particular project and audience. However, using this generalized template as a starting point can provide a clear and effective framework to ensure you cover all the critical information and present a compelling pitch. The ultimate goal is to demonstrate your project's profitability, sustainability, and viability, providing potential investors with all the information they need to confidently back your venture.

To make the deck even more compelling, consider adding graphics, charts, and images to visually illustrate key points. This not only enhances the aesthetic appeal of your presentation but also aids in comprehension, making it easier for investors to see your vision and understand your strategy. Happy pitching!