Law Office Rent-vs-Buy Case Study with Full Downloads: A Real-world Analysis

Introduction

In this post, we will explore a real-world law office rent-vs-buy case study in the Metro Boston Region that has been modified to fictionalize key information. This analysis is particularly valuable for:

- Potential clients seeking examples of my work product

- Professionals who are analyzing similar decisions and are in search of inspiration for their own analysis, and

- Students looking to practice real estate LBO modeling with a simple, real-world scenario.

This case study features an office building rent-vs-buy analysis and includes a fully functional financial model that can be repurposed for your own long-term investment analysis. This model is built in the style of an LBO model but also incorporates an NPV via DCF in the rent-vs-buy analysis worksheet. It includes a functional high-level rent roll that could be repuruposed for really any long-term lease. At the bottom of this page, you can download the full Excel file, final presentation and PowerPoint backup, and source data that fed the original model.

Background

5 Consortium Ave is a 62.9k SF Law Office Building in Manchester, NH. The building currently has three owners, two of which are retired from the group and want to partially liquidate, and one is soon to retire and wants to completely liquidate.

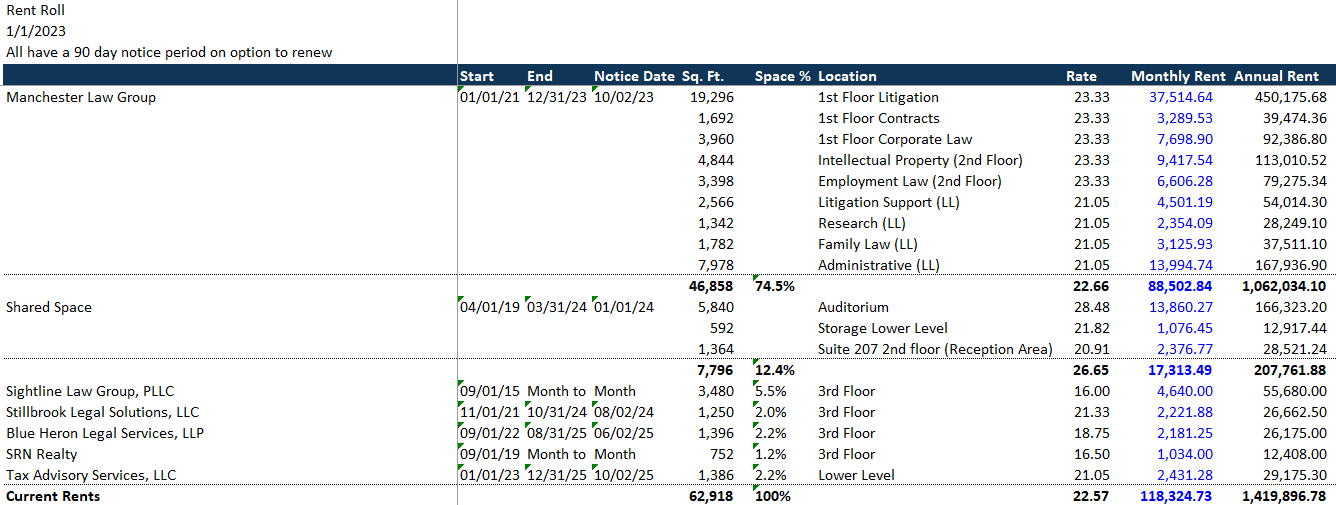

The five other practicing lawyers, known as the Practicing Group or Manchester Law Group, are currently renting the space and represent the largest footprint at 46.9k SF, or 74.5% of the 62.9k SF building. The other tenants also represent legal uses, barring SRN Realty, which occupies 752 SF or 1.2% of the building.

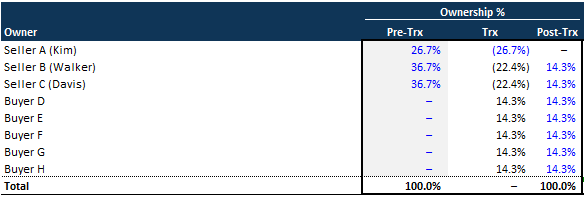

The Practicing Group and two of the Sellers (together, the "Buyer" or "Buyers") contemplate completely buying out one of the three Sellers and partially liquidating down the other two so there would eventually be seven equal owners (14.3% each). The current ownership wants to sell for $17.0M, and the buyers want to know if that is a fair price and how it would compare to renting over the next 10 years. They also want to understand a valuation methodology for when future lawyers enter and exit the business, so this situation does not happen again. It's important to note that this is an all-cash deal with no mortgage or other forms of debt.

Goals of this Analysis

The primary goals of this analysis are threefold:

- Determine if the proposed purchase price is reasonable over renting, given the buyers' long-term plans to occupy this building.

- Identify ways to value the building moving forward as partners of their law practice enter and exit.

- Explore how to execute this transaction in a tax-efficient manner.

Recommendation

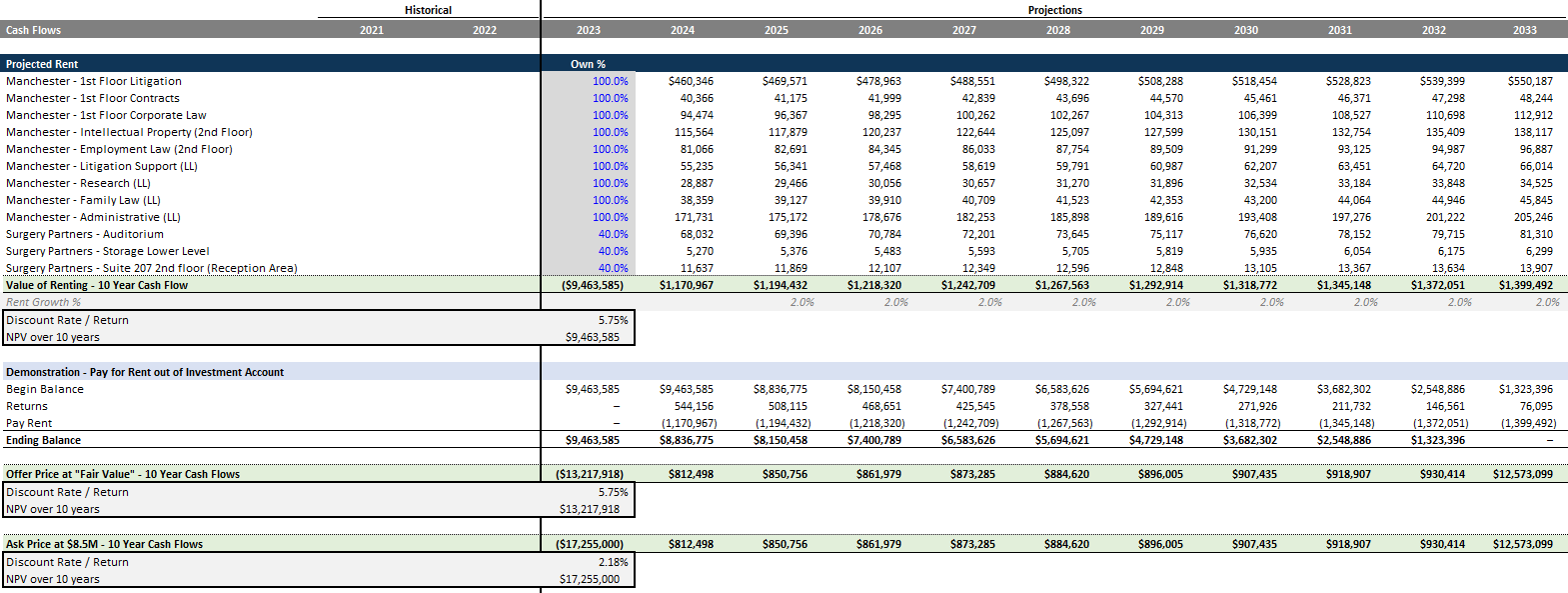

Our analysis suggests that the Practicing Group could fund $9.5M into a low-risk investment fund that yields 5.75%, and the returns would cover their rent for the next 10 years. Alternatively, if they wish to purchase the property for a similar rate of return, they could justify spending up to $13.2M. However, this figure should be gross, and the seller should fund any deferred capital expenditures identified by 3rd party reports out of the $13.2M at closing. The $17.0M asking price would yield a 2.2% return, which is less than what the buyers could achieve with a high-yield savings account or risk-free treasuries. It's important to note that this office rent-vs-buy analysis assumes the Practicing Group covers 100% of the rent for Manchester Law Group and 40% of the rent for the Shared Space detailed in the rent roll, amounting to a total rent payment of $1.2M in the first year of the projection period.

Data Available

To conduct this analysis, we utilized the following data:

- January 2023 Rent Roll PDF

- 2021 and 2022 Financial Statement PDFs

Conclusion

This Law Office Rent-vs-Buy Case Study serves as an excellent learning opportunity for those interested in real estate financial modeling. By downloading the provided files and exploring the analysis, readers can gain valuable insights into real-world scenarios and how to approach similar rent-vs-buy decisions. This case study also showcases the quality of work product potential clients can expect, making it a valuable resource for both learning and professional portfolio building.

Analysis Working Notes

A few technical notes about the model:

- Convert all PDFs to Excel using https://extracttable.com.

- Note all follow-up diligence items as we worked through the available data. For instance, we identified potential deferred maintenance based on low capital spend in the past three years. We suggested to buyers that their purchase price should be netted against any deferred maintenance identified by third parties. In other words, their offer should account for any surprises, which would need to be funded by their offer price. This recommendation reflects the maximum cash they can outlay for this entire deal.

- Utilize the financial backend to easily paste in new data, with validations in place to catch any mistakes or incorrect transpositions from ExtractTable. We use the subtotals to validate that the sum of each individual item makes sense.

- Other checks are built throughout the model and summarized in cell A1 and A2 of every worksheet

- The model sheets are organized into logical groupings, with 'divider >' tabs between each

- When possible, we make use of Excel's new Dynamic Arrays to minimize repetition and enhance the speed and efficiency of our analysis

- Create tags to validate the subtotals and establish standardized language for accounts in our model, addressing two issues simultaneously.

- Adhere to industry-standard font colors denoting: hardcodes (blue), links (green), and formulas (black).

The financial model should be self-explanatory, but I am happy to answer any questions. If I receive enough follow-up questions, I'll consolidate them into a subsequent post.

Download Links

You may download the full working folder here: